Written By: Valerie L. Richter

25 years ago, my husband and I took these solemn vows. In a nation where the divorce rate is nearly 50%, we are here to say that LOVE can still win! Mutual love, faith, respect and championing your spouse are some of the most beautiful gifts you can give!

Divorce is NOT in our vocabulary!

In the days when we were first engaged, we agreed that “divorce” was never going to be part of our vocabulary. No matter how hard things would get, we vowed to never give up on each other.

Gary and I met in high school, in the choir room. I was 14 and he was 16. He was rehearsing a solo for an upcoming competition, and I was the student aide for our choir director. I was mesmerized by his deep bass voice! In that moment, we caught each other’s eyes and the pursuit began. We played footsie under the table while listening to a friend sing at that competition. Later that week, at a cast party for “Annie”, he kissed me and the love affair began!

Most people seem to have the opinion that high school romances rarely last, let alone turn into a healthy marriage. We were the exception to that opinion! We dated five years before getting engaged, and after two more years, we got married. Today, we are more in love with each other than ever. What makes it work?

Today, we are more in love with each other than ever. What makes it work?

Before you think it was a bowl of cherries, we have had our struggles over the years. I was very jealous of his time in the early days of our marriage. As a new bride, I didn’t want to share my husband with his friends and family. Slowly but surely, I realized that family and friends are SO important. The love that we both show for family and friends is actually a gift to each other. It shows we care about our spouse as a whole, respecting and loving all the other special people who love our spouse.

Do special things for each other.

In our early years , we were just starting our careers and didn’t have much extra money for entertainment. My husband surprised me with an elaborate scavenger hunt for my birthday. He prearranged and planted clues at various locations around the city. He drew word picture puzzle clues and had me stopping at a gas station, local park and grocery store. The scavenger hunt was so fun and memorable, that I forgot what the actual gift was at the end. Lesson: The fact that he had taken so much time to thoughtfully plan out the adventure meant so much to me. My heart grew a little bigger!

That same year, I became pregnant with our first child. I was still working and got very weary at the end of each workday. My husband was so caring, he prepared a bubble bath for me each night to help me relax.

When the children began to arrive, our love and patience were tested on a whole new level.

When the children began to arrive, our love and patience were tested on a whole new level. Of course, we were elated to have such beautiful babies and were excited about the road ahead of us as parents. But along with the joys, come the trials.

One night, our baby girl would NOT stop crying. We were such brand new parents and had not gotten much sleep for days. We tried everything….feeding, singing, rocking, walking….yet her crying did not cease. As a last resort, we put her in the car seat and the three of went for a drive at 3 o’clock in the morning. We were at our wits end. I remember a shouting match in the car because of pure frustration. Finally, the baby fell asleep to the motion of the car. We silently drove back home, gingerly brought her into the house, and carefully laid her in her crib. We went to bed without a word.

I was told to never go to bed angry by my grandmother and my mother. We broke that golden rule. However, we loved each other so much, that we talked about it right away the next morning. We both apologized and realized it was out of frustration in the moment. We vowed to never let that happen again.

Plan date nights.

When you are in the throws of parenthood, it’s easy to get wrapped up in the children. It can be easy to neglect putting time into your marriage. We made sure this was not going to happen. We were blessed with great family that offered to watch the children on occasion so that we could go on a “date”. We also hired babysitters. These dates were often just dinner and a walk in the park, or dinner and a movie. It was time for us to relax and enjoy each other. This small, but ironically, giant gesture invests in your marriage.

Grow in your faith.

We had always been involved in childhood churches. When we got married, we had both a Catholic priest and a Methodist minister preside over the wedding. However, we wanted to find a church that we could both agree on and attend. A good friend of ours invited us to his church one Sunday. We were so drawn in by the music and the sermons, that we became regular attenders shortly thereafter. It was the first time in a long time that both of us learned something from a sermon. We felt like the pastor was talking directly to us and the Bible had actual application to our lives. This was new…and exciting!

It wasn’t long before we involved our children in the Sunday school programs. They would come home and teach US something new about our faith! This made us very curious about how we could learn more. We got involved in a neighborhood Bible study with other couples of all ages. We also got involved in men’s and women’s Bible studies. It was amazing! Not only were we able to meet and form relationships with others, we were growing in our faith…and in our love for one another.

We realized God needed to be the center of lives.

We realized God needed to be the center of lives. “With God, all things are possible.” – Matthew 19:26. Within the first eight years of marriage, we had moved five times, had three children, changed jobs twice, and dealt with some health scares. Our dependence on God was crucial during those years (and still is today!).

I remember crying out to God one night, “Help me Lord, I don’t know how to handle this frustration. Help me parent like you would parent.” God met me there and spoke into my heart. I learned patience, perspective and perseverance. God opened doors for me to be mentored by other moms through motherhood retreats called, “Hearts at Home” and a Bible study called, “Moms and More”. It was a time of great encouragement to live along side other women who cared for each other and mentored each other in the process. I shared this wisdom with my husband and our faith grew stronger.

Have “couch time”.

One of the valuable nuggets I took home from a Hearts at Home conference was to “have couch time”. It simply meant that when daddy came home, he would greet everyone and then take 5-10 minutes to talk to mommy on the couch. That meant the kids had to play quietly while mom and dad talked to each other about their days. This did two things. First, it gave my husband and I a chance to greet and appreciate each other. Second, it modeled love and a healthy marriage to our children. They saw that mommy was important to daddy and vice versa. We grew in our love and the children grew in love and patience.

The teen years….emotional rollercoaster!

We were a busy family. We had incredible experiences, celebrated many accomplishments and had our share of growing pains. With God as our center, we praised Him for the good and cried out to Him in the struggles.

Never underestimate the power of prayer and the value of Christian relationships. These years were some of the best and some of the worst at times. Our parents and siblings were some of the best counselors to our children when they temporarily went astray. Also, those friends and pastors at church were a lifeline to our kids when they needed help. As a team, we all came together to love, rebuke and encourage our children. My husband and I grew even closer and stronger in our faith and love for each other.

Champion each other!

My husband is a successful industrial designer and an incredible artist! Throughout the years, the children and I have championed his accomplishments! Whether he volunteered to do the set for the church musicals/ballets, won awards in ice sculpting or was commissioned to create artwork for the community, we all proudly cheered him on! Embrace your spouse’s talents, gifts, skills and compassion for others. Appreciation and admiration is a gift!

Show respect!

The world inundates us with sitcoms and social media that glorifies slamming your spouse. Think about it, how would you feel if you were on the receiving end of this? I know I’d feel pretty awful…even if it is supposed to be comical. I learned long ago, that it is so honoring to respect your spouse. In growing our faith and love for each other, we have grown in maturity as well. Refining our behaviors, choosing wisely about what we listen to and watch, and supporting each other through all situations has developed a mutual, loving respect. It also models respect to our children and those around us. Our hearts have grown bigger.

“Love is patient, love is kind. It does not envy, it does not boast, it is not proud. It does not dishonor others, it is not self-seeking, it is not easily angered, it keeps no record of wrongs. Love does not delight in evil but rejoices with the truth. It always protects, always trusts, always hopes, always perseveres. Love never fails.” – 1 Corinthians 13: 4-8

For Richer or for Poorer…

Many families strive to offer the best for their children and themselves. We were no exception. There were dance lessons, piano lessons, voice lessons, trombone lessons, baritone lessons, soccer, football, t-ball, softball, basketball, Tae Kwon Do, Lego League, Children’s Choir of Waukesha, Girls Club, Boys Club, musicals, acting classes, honor choirs, honor bands, marching band, solo-ensemble, art classes, contests, and the list goes on! Along with those expenses there were medical bills, vet bills, home improvements, credit card bills, car loans, mortgages, etc. We were slowly digging ourselves into a huge pile of debt…one emergency away from financial disaster!

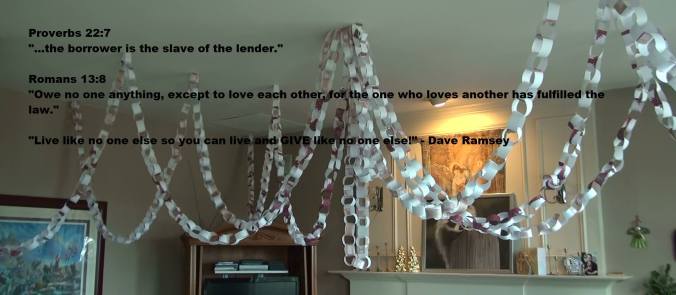

Many marriages are strained or end up in divorce because of financial stress. We needed help. So with prayer and specific resources, we were able to begin our debt-free journey. This drew us EVEN CLOSER as a married couple. You have to be on the same page to attack a mountain of debt. Together with God, we were able to pay off over $168,000 in debt! (For more information, refer to past Meaningful Journey blogs.)

Make intimacy a priority.

As a mother, employee and community volunteer, I had many people vying for my attention. The last thing on my mind was intimacy after a long day. I loved my husband, but I had NO energy left. A wise mother and grandmother once said, “Make intimacy a priority”. Ladies, you have to make an effort. I discovered something, it became a blessing. It draws you closer to each other in a way that only God could design.

Rediscover each other.

This year, we became empty-nesters. One child is now married and the other two are almost graduated from college. It was definitely a huge transition for us. When you are suddenly left with a quiet house, you can do one of two things. Grow apart because you don’t know each other anymore, or you can adopt four black cats. Just kidding…(well, we did adopt four black cats). Seriously though, we became intentional about rediscovering each other.

We started doing more things together like leading a financial study at church (Financial Peace University), painting ballet sets, exercising, taking a counseling class to further our counseling skills, completing yardwork projects, travelling and watching YouTube videos to learn more about our interests. We even planned a very special trip to Hawaii because we are celebrating our 25th wedding anniversary.

In Sickness and In Health…

Finally, there is something very special about your spouse supporting and caring for you you in times of sickness. My husband and I have cared for one another several times during illnesses. Most recently, I had a serious heart issue and knee problems. Because we had  been faithful about taking charge of our finances, I was able to quit my job and focus on healing after surgery and physical therapy. We alleviate stress for each other by being smart with finances and caring for each other during illnesses. I couldn’t ask for a wiser, stronger, more compassionate, caring and loving husband. He is such a blessing to me.

been faithful about taking charge of our finances, I was able to quit my job and focus on healing after surgery and physical therapy. We alleviate stress for each other by being smart with finances and caring for each other during illnesses. I couldn’t ask for a wiser, stronger, more compassionate, caring and loving husband. He is such a blessing to me.

So remember, LOVE CAN WIN! Kiss each other goodnight and kiss each other goodbye in the morning. Love, respect and champion your spouse, all the while, keeping God at the center. “A triple-braided cord is not easily broken.” Ecclesiastes 4:12

been faithful about taking charge of our finances, I was able to quit my job and focus on healing after surgery and physical therapy. We alleviate stress for each other by being smart with finances and caring for each other during illnesses. I couldn’t ask for a wiser, stronger, more compassionate, caring and loving husband. He is such a blessing to me.

been faithful about taking charge of our finances, I was able to quit my job and focus on healing after surgery and physical therapy. We alleviate stress for each other by being smart with finances and caring for each other during illnesses. I couldn’t ask for a wiser, stronger, more compassionate, caring and loving husband. He is such a blessing to me.