Written By: Valerie L. Richter

Photo By: Rising Capital Associates

The average American has $16,748 in credit card debt, $28,948 in auto loans, $49,905 in student loans and $176,222 in mortgages, according to the 2016 Federal Reserve Q4 report. That’s A LOT of DEBT! It’s no wonder that most of us feel HOPELESS when it comes to getting out of debt. I’m here to tell you that it’s possible to become DEBT FREE!

It’s possible to become DEBT FREE!

It HAS to start with a paradigm shift. Our culture tells us to buy what we “deserve” and “make easy, low payments” on this and that, and such and such. We are marketed to death by companies that want our hard-earned money. They are not bad. But we need to be AWARE and we need to BE SMART.

Banks advertise personal loans, mortgages, car loans and line-of-credit loans that make it “easier” for us to afford homes that are above what we should spend, home remodels we can’t afford, expensive cars we can’t pay cash for, and debt consolidation, which is a result of increased interest rates due to the fact that our debt-ratio is too high!

Why can’t we live within our means?

Why can’t we live within our means? Sure, we TRY to do this, but SOMETHING always comes up…a car registration fee, a birthday, a meal out, Christmas, etc. These are emergencies we need to put on our credit card, right? WRONG. Guess what? Car registrations, birthdays, and even, Christmas, happen every year! Imagine that!

OK, so maybe you plan for THOSE expenses, but what about car repairs, medical bills, field trips, vet visits, etc.? How can we pay for these emergencies? This is where your paradigm shift begins.

Create a ZERO-BASED BUDGET. Use a SIMPLE and FREE tool like Dave Ramsey’s EVERY DOLLAR.com to plug in some simple numbers. TRUST ME, this is a MUST. Budgeting doesn’t have to be complicated, dry or boring. It can be quite freeing when you have a REALISTIC VIEW of what is happening financially. It’s simple, record MONEY IN and MONEY OUT. Your goal EACH MONTH is to tell every dollar where to go, instead of it telling you. I have used this tool faithfully, and it has resulted in a huge pay off…literally! Don’t worry, it will take 2-3 months of tweaking budgets to settle into the swing of things, but you WILL get there.

By creating a zero-based budget (telling every dollar where to go), you will begin to identify where you are overspending. You can also identify items that may be luxury items…something you may want to take out of your budget until you become debt-free.

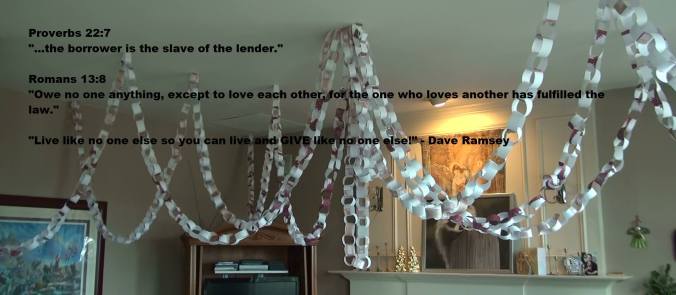

This is the next part of the PARADIGM SHIFT. A wise man, by the name of Dave Ramsey, has taught me the concept of how to “Live like no one else, so that we can LIVE and GIVE like no one else.” What does this mean? It means, evaluate what you can live without or decrease TEMPORARILY until you get out of debt. THEN, you will be able to live well and give generously to help others.

What kinds of things can I change?

- CANCEL PAID SUBSCRIPTIONS (magazines, newspapers, wine clubs, Netflix)

- CUT THE CABLE and choose Chrome Cast or rabbit ears.

- OPT FOR THE FREE HOME GYM verses gym memberships.

- NEGOTIATE CONTRACTS with your internet and cell phone providers. It’s easier than you think! Be sure to ask for a supervisor to get through the layers that are designed to keep you paying higher prices!

- SKIP THE STARBUCKS and make them “Your Bucks”! Coffee is easier than ever to make at home.

- DRIVE “NEW-TO-YOU” CARS (a.k.a. used cars, beaters, jalopies) and sell that expensive car or motorcycle. Don’t worry if you get teased for driving a less expensive car…you will smile triumphantly when you are out of debt and can afford whatever car you like!)

- SKIP THE MANICURES, PEDICURES, EXPENSIVE HAIRCUTS AND EXPENSIVE HOBBIES (golf, skiing, scrapbooking, shopping “just because”). Learn how to cut your own hair or enlist the help of a friend. Paint your own nails. Choose less expensive hobbies temporarily.

- SHOP AT ALDI (you can cut your grocery bill significantly)

- BUY CLOTHES/HOUSEHOLD GOODS at resale shops like Goodwill.

- ATTEMPT YOUR OWN CAR/APPLIANCE REPAIRS. Most auto parts stores will diagnose an engine code for free. YouTube videos are a great resource for learning how to do simple repairs (or complicated repairs if you are really adventurous!)

- EAT AT HOME. Dave Ramsey says, “You shouldn’t see the inside of a restaurant unless you are working there!”

- PLAN YOUR MEALS so your hunger doesn’t surprise you and create a food “emergency”!

- HAVE CREATIVE VACATIONS. Look for free events in town, visit your local park/beach and make a day of it, pack your own food/snacks when you venture out, have a couples “cooking night” by inviting others to bring an ingredient to cook/dine together, host a bonfire (s’mores are relatively inexpensive).

- PICK UP EXTRA HOURS/EXTRA JOBS. “The best place to go when you’re broke is to work!”, states Dave Ramsey. Make money with hobbies, delivering pizzas, etc.

- RENT FREE MOVIES FROM THE LIBRARY

- AVOID DISCOUNT WAREHOUSES (like Costco and Sam’s Club). How many times have you come out of there spending MUCH MORE than anticipated? Do you really need that 5lb. jar of mustard? Plus, you’ll nix the annual membership fee!

- SELL STUFF (rummage sale, E-Bay, Craigslist, etc.). Dave says, “Sell so much stuff the kids or the pets think their next!”

- USE CASH! “Feel the money, ” and feel the purchase. Using cash instead of plastic allows EACH PURCHASE to register emotionally!

- DON’T FINANCE FURNITURE, CARS AND OTHER STUFF. Companies do a great job of marketing debt. Businesses like car dealers make the most money on finance plans and warranties verses the actual sale of the car! Banks make their money by lending it to you (INTEREST). Imagine all the wasted money we’ve spent over the life of each and every loan!

- STOP USING CREDIT CARDS! By budgeting and making all the above changes, you should be able to save $1000 for a starter emergency fund ($500 if your annual income is $20,000 or less). This will be your cushion so you can stop using those credit cards. Eventually, you will want to pay all those off and CLOSE them. (Again, INTEREST is not your friend.) Some people claim to use credit cards for the reward “points” and pay off the balances each month. How many extra purchases did you talk yourself into to get those “points”? How long would it take you to actually save money for those reward items verses the long time it took to accumulate the “points”? Credit card companies know exactly how long!

- USE A DEBT SNOWBALL (after you have saved $1000 in your starter emergency fund). http://catalystaz.com/media/fpu-debt-snowball.pdf The basic premise of a Debt Snowball is to list all your debts, SMALLEST to LARGEST, not including the mortgage (don’t worry about interest rates). Start by paying off the smallest debt first. Then, add the minimum payment you were making on that first debt to the second debt…pay that one off…and so on and so forth. Your debt payment picks up more “snow” as it goes along, paying them off faster.

- BE CONTENT. Our culture needs a lesson on contentment. We don’t need the newest I-phone, the bigger TV, the more expensive car, the fast food salad we could have easily made at home, the fancy cup of coffee, the bigger house, the fancy gym, or the designer clothes to be content in life. Even the smallest of incomes in the United States is considered “rich” by the standards of many other countries.

The FINANCIAL PEACE that comes with financial freedom is priceless. We, like so many other Americans, lived paycheck to paycheck. We were one emergency away from a financial disaster. By budgeting, evaluating expenses, telling every dollar where to go, saving $1000 for a starter emergency fund, paying with cash and closing credit cards/store accounts, we have paid off over $168,000 in debt! We are on our way to becoming debt free!

What are the next steps? Stay tuned for the next weekly blog, “Pay Off the Mortgage Early and Make a Plan for Retirement”. Also, if you have questions regarding Financial Freedom or anything written about in these blogs, please contact me below. I will be sure to respond!

Recommended Resources: DaveRamsey.com, EveryDollarcom